Paid for by Better Schools for Better Communities, Walt Modde, Treasurer

Better SchoolsCommunitiesSikeston

Vote Yes on April 7, 2026

1Month00Weeks00Days

If passed, how would the bond impact my personal and property taxes?

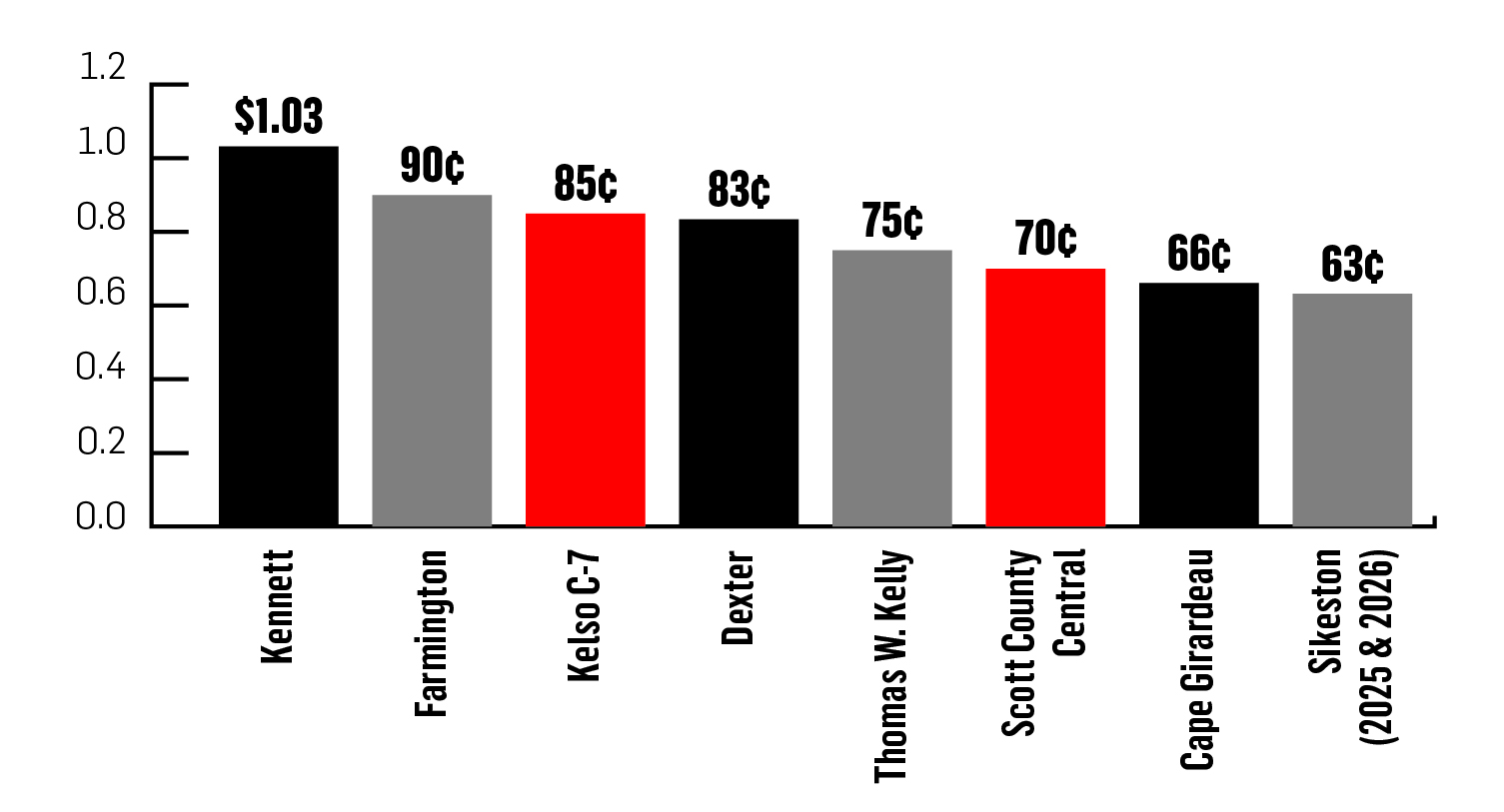

The Sikeston R-6 school levy will remain 63 cents per $100 of value. This mean no increase in the school levy.

School levy including debt would go from $3.864 to $4.284 on personal and property tax multiplied by $100 per assessed value.

Take School R-6 line from 2019 tax assessment receipt and multiply by 1.11. The total will be your assessment for R-6 beginning in 2020.

The bond will increase the School R-6 tax by 11 percent on your county assessment.

Examples

$660 (2019 property tax) X 1.11 = $732.60 in 2020

$124 (2019 personal property tax) X 1.11 = $137.64 in 2020

#schools4 sikestonsikeston

6 Things to Know

- Better Schools Better Communities bond vote will be on April 7, 2026

- No tax levy increase

- Seeking approval for Sikeston R-6 voters for $11.3 million in bonds

- Total Phase 4 Master Facilities Plan is $11.3 million

- Lee Hunter and Wing Elementaries Expansion

-

Construct new Performing Arts classrooms

Mailing Address

Better Schools for Better Communities

P.O. Box 607

Sikeston, MO 63801

Co-Chairs for Better Schools Better Communities

Aaron Boyce

Liz Littleton

questions@schools4sikeston.com

![IMG_3053 (2)[1] IMG_3053 (2)[1]](https://schools4sikeston.com/wp-content/uploads/2025/11/IMG_3053-21-360x218.jpg)